Curiosity kills the cat they say.. But sometimes it ain't a bad idea to look around for options and try somethings out no matter how pessimistic you are about it..

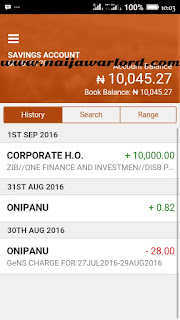

The illustration led me down the pathway to downloading the PayLater app to see what all the buzz is all about.... . Was I impressed with how easy it was getting a loan with no collateral and a meagre 1% interest a day for the N10,000 and even lower percentage rate on the N30,000 for as low as 0.5%.....[impressive]

Register here at PAYLATER WEBSITE or for easier access you can download the Paylater app here and follow the guide : PAYLATER V1.06 APP DOWNLOAD

Frequently Asked Questions about PayLater

How does it work?

Complete our 100% online application in minutes and submit. We’ll review your information and communicate a decision to you within minutes. If approved, you will receive funds directly into your preferred bank account within 24 hours of loan approval.

How much can I borrow from Paylater? For how long?

For your first loan, you can borrow up to ₦10,000 for a period of up to 30 days. You decide how much you want and how long you want it for. Once you have paid your first loan on time, the possibility of you receiving a higher credit limit increases. The more times you take a Paylater loan and repay successfully, the more we can lend to you.

How do I apply?

Connect your Facebook account to identify yourself and this will take you to our brief registration & application forms. Use our calculator to determine how much you would like to borrow and your expected repayments. Fill the application out with valid information and submit. We will notify you instantly of the loan decision.

How do I repay my loan?

There are several options to repay your Paylater loan. If you want to make an online payment on/before your due date, please follow these steps:

Visit www.quickteller.com/onecredit

Select Paylater

Enter in your details. Please ensure you enter in your client ID and other details accurately.

Enter in your card details and confirm the transaction. Your account will automatically be updated within minutes.

If you prefer to repay on/before your due date, you can make a direct transfer to the listed bank account:

Account Name: Paylater

Bank: Guaranty Trust Bank (GTB)

Account Number: 0217599035

Please include your full name and client ID on the transfer details and notify us immediately you make a repayment. Repayments made via cash transfer are typically updated on our platform within 1 - 2 business days

I was approved for a loan, why have I not yet received my funds?

Funds are typically received within 24 hours of loan approval. Please let us know if you have not received the transfer after that period. However, we also advise that you check your account balance directly as credit alerts are not always received with transfers.

Why is my Bank Verification Number (BVN) required?

We request your BVN as this is used to verify that the individual applying for a Paylater loan is the same as the owner of the provided bank account. This is to ensure that your details cannot be used to apply for a loan without your authorization in the event a 3rd party has access to your account details. Please note that your BVN details cannot be compromised without your biometric data.

I don’t know my BVN. What do I do?

Just dial *565*0# This will only work if you are making the request from the same phone number that you used to register for the BVN service.

What documents do I need to submit?

You do not need to submit any documents to get a Paylater loan. We’ll just ask you for some basic information so we can get to know you better. All you need to have is a valid Facebook account to verify you and a functional BVN-linked bank account to receive funds in.

Can I make an early repayment? If I make an early repayment, will I pay less?

Early repayments are accepted and you can apply for a new loan immediately your previous loan is paid off. However, please note that early repayment does not imply that the terms of your loan obligation will change. Your repayment terms are fixed at the point of loan application and the total amount to be paid is not changed by an early repayment.

Who has access to my data?

Paylater never shares your personal details with third parties, unless it is for dedicated business purposes, such as reporting of loan defaulters to authorized Credit Bureaus. It is therefore important to ensure that you repay your loan on time so your credit history is not negatively affected. If you make timely repayments, this increases your chances of accessing credit from financial institutions in future.

I did not receive my phone verification code, what do I do?

When you submit an application, you should receive an SMS link from us to the mobile number you provided. Please click on that link within 24 hours of your application to verify your number and receive a loan decision. If you are certain that you did not receive a message, please ensure that your provided number is switched on and is in an area with good network service to receive the SMS. Note: A data connection is required in order to validate your phone number.

Why was my loan application rejected?

There are a few reasons behind loan application rejections. The most common reason is that the applicant didn’t share all of the information required in the application or filled in invalid details. However, there can be other reasons. As a responsible lender, we take steps to ensure we only extend credit to the right profile of applicant, so that our clients won’t become too indebted. Another reason is that the applicant simply doesn’t match the profile we normally lend money to. Whatever the situation, we recommend coming back to the site in 1 or 2 months to re-apply, since the criteria of these decisions are constantly refined.

Who should I contact to submit a comment, question or complaint?

Feel free to reach out to us any time at customer@paylater.ng or find us on Facebook at www.facebook.com/paylater. We will do our best to attend to you as quickly as possible.

What happens if I can’t make a payment on my due date?

We understand that financial circumstances can change suddenly, however, please note that we do not schedule repayment dates and you should only take a Paylater loan if you are reasonably certain you have the means to repay.There may be fees associated with late repayments. In addition, defaulting loans are reported to national Credit Bureaus and this can severely affect your ability to access loans in future. We therefore advise you take every effort to meet your obligations on time.

Does my account need to be funded before application?

You don’t require any funds in your account prior to taking a Paylater loan. Our loans are intended to meet your urgent cash needs!

Can I access Paylater from any location?

Paylater is available in all 36 states of Nigeria.

Why is my bank account required?

It’s important for us to send your funds to your preferred account, as quickly as possible. We request bank account details as that is where we will disburse funds to, if approved.

Why do you need my card details?

We ask for card details in order to receive your loan repayments on your due date. However, you also have the option to pay by cash to our listed account if you would prefer. Paylater understands that this is very sensitive information, so we have secured our platform to protect all your data.

What is a client ID? How do I find mine?

Your client ID is the unique number Paylater uses to identify you. Think of it as your account number with us. It is sent via SMS when your loan is approved, and in all e-mails we send to you. It can also be accessed by logging into your account on www.paylater.ng. Please take note of this ID as it should be used for resolving account issues speedily or on any repayment narrations for quick identification.

Continued at the FAQ PAGE OF www.paylater.ng

The illustration led me down the pathway to downloading the PayLater app to see what all the buzz is all about.... . Was I impressed with how easy it was getting a loan with no collateral and a meagre 1% interest a day for the N10,000 and even lower percentage rate on the N30,000 for as low as 0.5%.....[impressive]

Register here at PAYLATER WEBSITE or for easier access you can download the Paylater app here and follow the guide : PAYLATER V1.06 APP DOWNLOAD

Frequently Asked Questions about PayLater

How does it work?

Complete our 100% online application in minutes and submit. We’ll review your information and communicate a decision to you within minutes. If approved, you will receive funds directly into your preferred bank account within 24 hours of loan approval.

How much can I borrow from Paylater? For how long?

For your first loan, you can borrow up to ₦10,000 for a period of up to 30 days. You decide how much you want and how long you want it for. Once you have paid your first loan on time, the possibility of you receiving a higher credit limit increases. The more times you take a Paylater loan and repay successfully, the more we can lend to you.

How do I apply?

Connect your Facebook account to identify yourself and this will take you to our brief registration & application forms. Use our calculator to determine how much you would like to borrow and your expected repayments. Fill the application out with valid information and submit. We will notify you instantly of the loan decision.

How do I repay my loan?

There are several options to repay your Paylater loan. If you want to make an online payment on/before your due date, please follow these steps:

Visit www.quickteller.com/onecredit

Select Paylater

Enter in your details. Please ensure you enter in your client ID and other details accurately.

Enter in your card details and confirm the transaction. Your account will automatically be updated within minutes.

If you prefer to repay on/before your due date, you can make a direct transfer to the listed bank account:

Account Name: Paylater

Bank: Guaranty Trust Bank (GTB)

Account Number: 0217599035

Please include your full name and client ID on the transfer details and notify us immediately you make a repayment. Repayments made via cash transfer are typically updated on our platform within 1 - 2 business days

I was approved for a loan, why have I not yet received my funds?

Funds are typically received within 24 hours of loan approval. Please let us know if you have not received the transfer after that period. However, we also advise that you check your account balance directly as credit alerts are not always received with transfers.

Why is my Bank Verification Number (BVN) required?

We request your BVN as this is used to verify that the individual applying for a Paylater loan is the same as the owner of the provided bank account. This is to ensure that your details cannot be used to apply for a loan without your authorization in the event a 3rd party has access to your account details. Please note that your BVN details cannot be compromised without your biometric data.

I don’t know my BVN. What do I do?

Just dial *565*0# This will only work if you are making the request from the same phone number that you used to register for the BVN service.

What documents do I need to submit?

You do not need to submit any documents to get a Paylater loan. We’ll just ask you for some basic information so we can get to know you better. All you need to have is a valid Facebook account to verify you and a functional BVN-linked bank account to receive funds in.

Can I make an early repayment? If I make an early repayment, will I pay less?

Early repayments are accepted and you can apply for a new loan immediately your previous loan is paid off. However, please note that early repayment does not imply that the terms of your loan obligation will change. Your repayment terms are fixed at the point of loan application and the total amount to be paid is not changed by an early repayment.

Who has access to my data?

Paylater never shares your personal details with third parties, unless it is for dedicated business purposes, such as reporting of loan defaulters to authorized Credit Bureaus. It is therefore important to ensure that you repay your loan on time so your credit history is not negatively affected. If you make timely repayments, this increases your chances of accessing credit from financial institutions in future.

I did not receive my phone verification code, what do I do?

When you submit an application, you should receive an SMS link from us to the mobile number you provided. Please click on that link within 24 hours of your application to verify your number and receive a loan decision. If you are certain that you did not receive a message, please ensure that your provided number is switched on and is in an area with good network service to receive the SMS. Note: A data connection is required in order to validate your phone number.

Why was my loan application rejected?

There are a few reasons behind loan application rejections. The most common reason is that the applicant didn’t share all of the information required in the application or filled in invalid details. However, there can be other reasons. As a responsible lender, we take steps to ensure we only extend credit to the right profile of applicant, so that our clients won’t become too indebted. Another reason is that the applicant simply doesn’t match the profile we normally lend money to. Whatever the situation, we recommend coming back to the site in 1 or 2 months to re-apply, since the criteria of these decisions are constantly refined.

Who should I contact to submit a comment, question or complaint?

Feel free to reach out to us any time at customer@paylater.ng or find us on Facebook at www.facebook.com/paylater. We will do our best to attend to you as quickly as possible.

What happens if I can’t make a payment on my due date?

We understand that financial circumstances can change suddenly, however, please note that we do not schedule repayment dates and you should only take a Paylater loan if you are reasonably certain you have the means to repay.There may be fees associated with late repayments. In addition, defaulting loans are reported to national Credit Bureaus and this can severely affect your ability to access loans in future. We therefore advise you take every effort to meet your obligations on time.

Does my account need to be funded before application?

You don’t require any funds in your account prior to taking a Paylater loan. Our loans are intended to meet your urgent cash needs!

Can I access Paylater from any location?

Paylater is available in all 36 states of Nigeria.

Why is my bank account required?

It’s important for us to send your funds to your preferred account, as quickly as possible. We request bank account details as that is where we will disburse funds to, if approved.

Why do you need my card details?

We ask for card details in order to receive your loan repayments on your due date. However, you also have the option to pay by cash to our listed account if you would prefer. Paylater understands that this is very sensitive information, so we have secured our platform to protect all your data.

What is a client ID? How do I find mine?

Your client ID is the unique number Paylater uses to identify you. Think of it as your account number with us. It is sent via SMS when your loan is approved, and in all e-mails we send to you. It can also be accessed by logging into your account on www.paylater.ng. Please take note of this ID as it should be used for resolving account issues speedily or on any repayment narrations for quick identification.

Continued at the FAQ PAGE OF www.paylater.ng

0 comments:

Post a Comment